How the federal bonus depreciation restored to 100% will impact Michigan farmers

On July 4, 2025, the One Big Beautiful Bill (“OBBB”) was signed into law to extend, enhance and, in some cases, make permanent some of TCJA’s tax law changes. At the federal level, a couple of significant provisions for farmers were:

- Bonus depreciation was reinstated to 100% and made permanent for now. Be sure to note this is for qualified capital expenditures acquired and placed in service after January 19, 2025. Qualified property purchased prior to January 20, 2025, are only eligible for a maximum of 40% bonus depreciation, even if not placed into service until after January 19, 2025.

- Section 179 allowed expense was permanently increased to $2.5 million for eligible property purchased and placed into service during tax years beginning after December 31, 2024. The investment purchase phaseout threshold was increased to $4 million for property placed in service in years beginning after 2024, with the allowed section 179 expense decreasing dollar-for-dollar as the investment amount during the tax year approaches $6.5 million, the level of being fully phased out.

These are two of the most significant levers farmers use to manage taxable income due to the capital-intensive nature of farming.

So why am I writing about this again? Well – there are state issues to consider. On October 7, 2025, Michigan’s Governor Gretchen Whitmer signed House Bill 4961 into law, enacting significant changes to the state’s tax code. This legislation formally decouples Michigan from several key business provisions of the OBBB – this article will focus on the decoupling around depreciation.

What does “decoupling” mean?

State “decoupling” occurs when a state chooses not to follow certain provisions of the federal Internal Revenue Code (IRC). Many states conform to the IRC on a rolling basis as it is enacted to simplify tax compliance. Decoupling allows states to diverge on specific federal laws for state tax purposes. This affects the calculation of income tax at the state level and generally does not change a taxpayer’s federal tax obligations. Federal taxable income remains determined by federal law; however, additional planning may be needed at the state level.

Michigan has historically been a rolling conformity state meaning it typically follows the IRC when federal law changes occur. This decoupling from certain OBBB provisions is a tremendous change. You will want to make sure you understand the impact of the change for state income tax purposes. Michigan farmers cannot complain too much though; our neighbors in Wisconsin have been working through no state tax bonus depreciation for years.

Effect of Michigan decoupling related to depreciation methodologies

For our farming customers, Michigan’s decoupling results in them no longer having the leverage of the following OBBB federal provisions for calculating their state taxable income for tax years beginning after December 31, 2024:

- Bonus Depreciation: Taxpayers can no longer fully deduct 100 percent of eligible equipment costs in the first year for state tax purposes. Michigan does allow bonus depreciation for all taxpayers other than C-Corporations of 40% for the year ending December 31, 2025, which was the pre-OBBB rule in place.

- Section 179 Expensing: Michigan retains pre-OBBB expensing limits, such as the lower cap of $1.25 million, even if federal limits are higher. The same effect occurs with the investment phaseout threshold retained at the pre-OBBB amount starting at $3.13 million and fully phasing out the Section 179 available amount once eligible investment purchases exceed $4.38 million.

The below example illustrates a farming sole proprietorship entity; however, the decoupling provisions apply to all business taxpayers who benefit from the OBBB provisions.

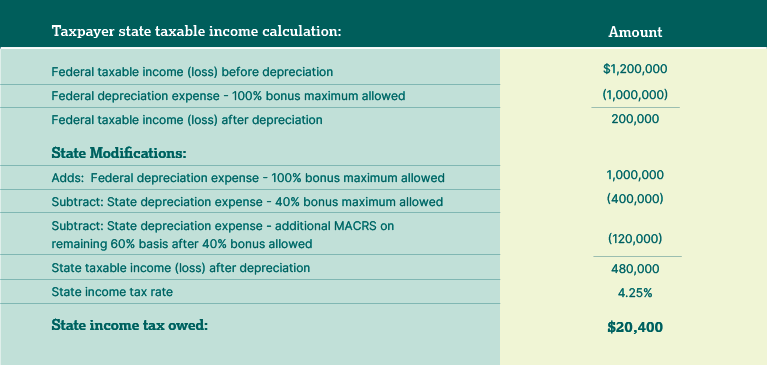

Example – Michigan Decoupling from OBBB’s Federal Bonus Depreciation

Scenario: Taxpayer is a Michigan 1040 Schedule F taxpayer that purchased and placed in service new five-year MACRS property, after January 19, 2025, totaling $1,000,000. This simplified example assumes there is no carryover depreciation available on fixed assets in service prior to December 31, 2024.

Federal Tax Effect: The OBBB will allow 100 percent bonus depreciation for qualified property acquired and placed in service after January 19, 2025.

- Taxpayer claims 100 percent depreciation on the $1,000,000 in assets in 2025.

- Federal depreciation deduction for 2025: $1,000,000

- Federal taxable income impact: Full $1,000,000 is deducted in 2025.

Michigan Tax Effect: Michigan has decoupled from IRC Section 168(k) 100% bonus depreciation as enhanced by the OBBB and reverts to the original 40% phased-down amount for the 2025 period due to following the provisions in effect as of December 31, 2024. Thus, when the individual calculates their Michigan individual income tax, federal taxable income will be adjusted by the unallowed increase of federal bonus depreciation at the state level.

Navigating uncertainty surrounding a State’s OBBB decoupling

Your situation is likely not as cut and dry as the one presented, but it gives a basic example of how the depreciation decoupling would work. As you can see in the above example, while Michigan decouples from federal depreciation methodologies in the OBBB, you can still take state bonus depreciation of 40% on assets placed in service in 2025 – which was the pre-OBBB tax law. Additionally, Michigan taxpayers can also utilize Section 179 expense, limited to $1.25 million in 2025. In this scenario, if the taxpayer wanted their Michigan taxable income to closely match their federal taxable income, their tax preparer could utilize Section 179 expense on the remaining basis and try to get them aligned.

Limitations with Section 179 include the $1,250,000 maximum expense and that Section 179 depreciation cannot take a business activity into a taxable loss situation.

With Michigan decoupling from several significant provisions of the OBBB, it is critical that proactive planning and additional time spent preparing your tax returns is taken to avoid unnecessary tax liabilities. Make sure you are an advocate for yourself this tax filing season – talk to your tax preparer and ensure that all methodologies available are considered to get you to where you want to be from an income tax standpoint this year and into future years.

This article was originally published in Michigan Farm News.

We’re here to help.

With locations across Michigan and northeast Wisconsin, we’re here when you’re ready to talk.