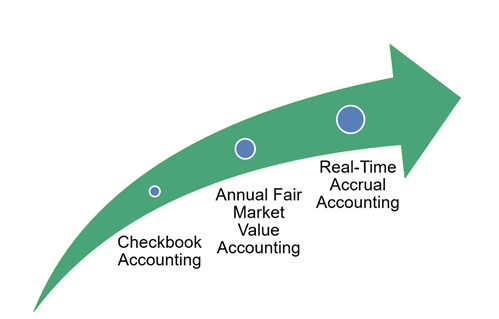

Farmers are used to calculating profits each year for their entire farm – whether that be on a cash basis, a fair market value basis, or on a real-time accrual accounting basis.

The Options:

Most farmers utilize the cash basis of accounting (or checkbook); i.e., recording income as cash is received and expenses when payments are made. This is the accounting methodology most commonly utilized for income tax purposes. Cash basis accounting does not accurately reflect the “true” net income of a farming operation. Many times farmers prepay for inputs or use aggressive bonus depreciation methodologies to drive profit down in successful years to manage income tax liabilities. From an accounting standpoint, this shows a low taxable income even though you truly had a great year.

A higher level of farm accounting builds on the cash basis of accounting by recording fair market value adjustments for crop inventories (crop harvested, but not yet sold) and growing crops; fair market values for property, equipment, and land; and accounts payable. This method of accounting is a better measure of overall farm profitability, but only when you record fair market value adjustments (which is typically on an annual basis).

The highest level of farm accounting is using accrual accounting on a real-time basis. Accrual accounting means when you purchase input costs or receive services for the farm, they are booked as a cost to the growing crop inventory account, and once the harvest is completed, these accumulated costs are then transferred over to a harvested crop inventory account and deducted as the crop is sold. Expenses are tracked for inputs and services received and unpaid amounts are recorded as liabilities. This gives you the most accurate representation of what your actual profit is at any point in time.

As you consider these accounting practices, where do you find yourself on the accounting spectrum? Are you working up the spectrum to better utilize your accounting records to help manage your farming operation?

What Else?

Farmers are faced with utilization questions all of the time. The questions sometimes feel never ending – what types of crops should I grow this year, should I try to rent or buy more ground this year, should I buy another harvester, should I do any custom planting and/or harvesting for others, should I pay for someone to custom raise my heifers or do we do it again this year, what do I do with downtime for my equipment as my farming operation is large enough that it needs more than 1 of everything but can’t fully utilize 2 of everything… and so on and so on. These are just a few of the questions that every farming operation should work through on an at least an annual basis.

One of the driving factors to consider when answering all of these questions with a yes or a no is: will we make more money now or will this set us up to be more financially successful in the future. With so many scenarios and options for farmers to create revenue, how can your financial statements help you make decisions on where to focus your time and efforts? How can you assess where in your operation you made money or not?

The answer: by completing enterprise, or profit center, accounting! Profit center accounting is the process of dividing your total farming operation into revenue streams and allocating all of your costs to these profit centers. It can be completed no matter where you are on the spectrum of the accounting scale – cash basis / checkbook accounting, annual fair market value accounting, or real-time accrual accounting.

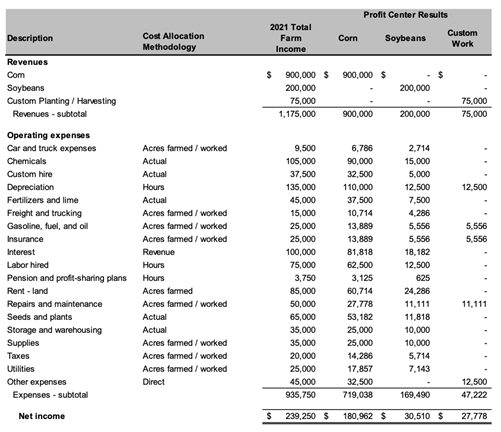

Below is an example of a farming operation with 3 profit centers – 2 profit centers from crops and 1 from a custom work operation:

As you can see in the example, all expenses are allocated to profit centers using some type of methodology – whether that be based on actual expenses, a per acre allocation, hours worked, etc. Cost allocations can be refined over time and adjusted based on experience – don’t think that you have to stick with something if it doesn’t make sense.

Tracking income and costs by profit center helps identify the real sources of profits in the business, and provides factual data for either expanding or discontinuing certain business activities. Be careful though - enterprise analysis does not identify or value any non-financial interactions between enterprises. For example, corn may appear to be more profitable than a legume crop such as soybeans or alfalfa.

However, growing continuous corn actually may be less profitable than a rotation containing other crops that contribute nitrogen to the soil, break up pest cycles, or spread out peak workloads.

Enterprise accounting takes extra effort, but the information it provides can be well worth it. If you are interested in learning more about any of these accounting options, contact your CPA or a local GreenStone branch. GreenStone offers a full array of accounting services for farmers and agribusiness owners.

Tags

Request for Information | Apply Now | Tax and Accounting Services