GreenStone’s appraisal team has completed a yearly land benchmark study, and the results ring positive for land owners in Michigan and northeast Wisconsin. Each year, GreenStone re-appraises the same eleven parcels of land representing local market areas across the geography. These re-appraisals are then compared to the prior year appraisals to understand value trends in cropland, transitional land, recreational land and dairy improvements.

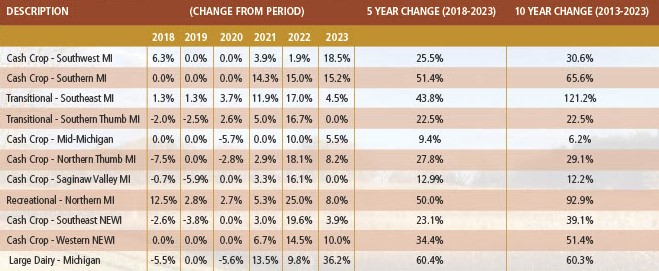

For the third year in a row, none of the eleven parcels of land we measure saw a decrease in value as outlined below.

How GreenStone Determines Land Trends

As a part of this annual evaluation, research is also done to understand why these values are increasing or decreasing. A rise or decline in commodity prices, input costs, interest rates, weather, tourism and labor availability can all play a role in determining the market value of real estate, as outlined in more detail below.

Other land value reports, like the USDA, often rely on the recollection or thoughts of agricultural lenders reported by survey. This survey method, while useful for general market awareness, lacks the extensive research, analysis, and expertise that supports GreenStone’s benchmarking study. Additionally, by re-valuing the same property every year, GreenStone eliminates most of the inherent variance present in survey methods and is able to focus solely on market trends.

Cash Crop and Dairy

The Saginaw Valley cash crop land did not see an increase in value for 2023, after seeing a more than 16% jump in value last year. It represents a historically strong agricultural area; this surprising stagnation may be an early indication of plateauing land values to come in other agriculturally rich communities.

All other cash crop focused trends saw the anticipated increases. While other factors are present, land scarcity and competition are the primary drivers of increasing values in these areas. For instance, the property located in western northeast Wisconsin is located in the western part of GreenStone’s northeast Wisconsin territory. This area is strongly influenced by the dairy market, producers are always looking for opportunities to expand their land base. This expansion increases competition for land and thus, increases land values.

The benchmark representing a CAFO sized dairy operation saw the largest year-over-year increase in value. Our team attributes this jump to increased construction costs and a stronger dairy market than in past years.

Transitional and Recreational

Transitional land, which is typically considered agricultural land being converted to urban development, saw a small increase in Southeast Michigan as indicated in the chart. However, the same land category in Michigan’s Southern Thumb benchmark property saw a plateau. After a significant increase in recreational land value last year, the northern Michigan benchmark this year indicates things are settling down in that area, as well. Given these results, it may be plausible that the boom in rural land buying during the COVID-19 pandemic is softening as a result of increasing interest rates.

These results benefit you!

While the price to acquire land is now higher, your existing land assets are also likely worth more today than last year. That is good news for current land owners, but presents challenges for those looking to purchase land in the future. Regardless of current buying complications, history has proven that the purchase of land is a solid investment into your future.

Tracking this data annually keeps both our customers and our staff aware of where values are headed and prevents any big surprises year after year; and informs our property appraisers to help accurately value land. GreenStone’s team of lending experts are here to help you navigate the fluctuating market and find solutions for your dreams!