This year definitely has illustrated the number of factors influencing your profitability that are seemingly out of your control. And while there are many things impacting your business, you can gain control of your tax situation if you plan ahead. Whether you believe you made little income or a lot in 2019, you will fare better with pre-planning. Additionally, since this is the second year of the new tax laws, planning may be more important than ever before!

Getting Started

It is important to understand the goal of tax planning is to minimize tax liabilities and ensure all available allowances, deductions, exclusions and exemptions are working together in the most tax-efficient manner, reducing the total income tax paid to an amount you are expecting. Tax planning does not remove obligations or change requirements, but can help eliminate any surprises at tax time.

Effective tax planning helps businesses achieve their financial goals and plan for their upcoming needs. When done properly, it should lower taxable income, reduce tax rates, provide for greater control of when taxes are paid, and maximize deductions and credits whenever possible.

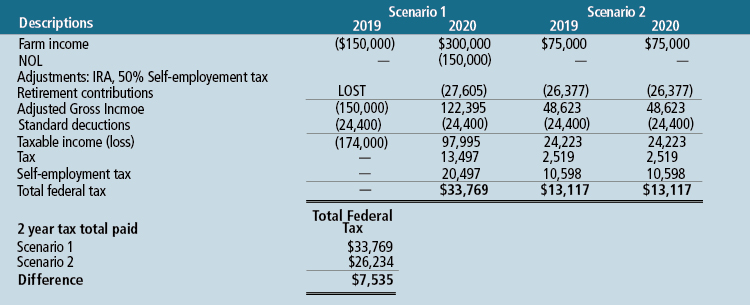

The photo above is a simplified illustration showing the importance of tax planning. In both scenarios, the two year combined farm net income is $150,000 (average of $75,000 per year). In Scenario 1, no tax planning was completed and a significant loss was recognized in year one. This led to the income tax benefit of adjustments and standard deductions being wasted and the taxpayer paying $7,535 more in income tax over a two year period than in Scenario 2. Effective tax planning, when possible, should avoid situations like the illustration on the right. Your Responsibilities While tax accountants are knowledgeable and generally well-versed in tax laws – they are not magicians, nor can they read minds. Therefore, it is critical you stay engaged in the tax planning process and provide the necessary information in order to receive efficient and effective guidance.

A few tax planning tips:

- Have your records in order: Having an accurate set of financial records is critical for a tax preparer to work with – preferably, not a shoebox of receipts. A computer program or a worksheet that reconciles back to your bank and debt statements is best. This is generally the first step in good financial planning and a piece that should not be ignored. If this is not something you want to do, it may be best to hire a bookkeeper or accountant to assist you.

- Don’t procrastinate: Waiting until the last minute to get your records in order is a big no-no. Waiting until December to start your bookkeeping for the year leaves you scrambling to complete activities to help your tax situation.

- Get off autopilot: It is not uncommon to see businesses make financial decisions that they shouldn’t have made because their books are not up to date. Examples include buying the same amount of prepaids as last year, or making a capital expenditure because you had to last year – only to find out that neither were necessary because you were in a different position than a year ago.

- Nothing is irrelevant: Make sure you tell your tax preparer about all equipment purchases. For instance, if equipment is dealer- or manufacturer-financed, it may not show up in your bank accounts if no payment was made in the tax year. That can be a sizeable capital expenditure your tax accountant doesn’t know about unless you tell them.

- Meet with your tax accountant early: Meet before the end of the year to discuss your current financial situation and what tax bracket you will likely be in. Allow enough time to bring in additional income if facing a net operating loss or to make additional purchases if your income is too high.

Frequent Tax Planning Strategies

There are a few tax planning strategies worth mentioning that, while they may not be applicable to every business, they are good reminders and important to keep on your radar.

Methods to increase taxable income:

- Election to capitalize repairs rather than expensing them – it can be adjusted annually.

- Maximizing depreciation methods, including direct and bonus expenses – try to never depreciate your way out of standard deductions and exemptions.

- If a farm loss is inevitable, common ways to increase income include: IRA distributions, IRA to Roth IRA conversions, sale of non farm capital assets (i.e. stocks), etc. An IRA to Roth IRA conversion generates taxable income on the tax return, but the earnings are tax-free. Any farm losses may be offset by the income generated from the rollover and no income taxes would be owed on the money rolled into the IRAs.

Methods to decrease taxable income:

- Farm income averaging: averaging all or some of your farm income using rates from the three prior years.

- Common expenditures to reduce taxable income: prepaying inputs and other allowed items, capital expenditures, and retirement contributions.

- Healthcare deductions: creating an employee benefits deduction to allow for business deduction of these expenses.

- Crop insurance deferrals: this likely will be more common this year given weather-related circumstances. Internal Revenue Code Section (IRC §) 451(f) provides a special provision that allows insurance proceeds to be deferred if they are received as a result of “destruction or damage to crops.”

Other required criteria to defer proceeds are as follows:

- The taxpayer uses the cash method of accounting;

- The taxpayer receives the crop insurance proceeds in the same tax year the crops are damaged; and

- The taxpayer shows that under their normal business practice they would have included income from the damaged crops in any tax year following the year the damage occurred.

- Selling under a deferred contract: you can sell grain before the end of the year, but not be paid until after the first of the next year. You then have flexibility to decide, after the fact, if you need additional income in the year that the crop was sold. Make sure you sell in several small contracts rather than one large contract to provide more flexibility for when to show income. Also, consider the risk of collection in your decision making process.

As we approach the end of the year, it is good to remember the importance of tax planning. Strategies listed within this article are commonly used; however, everyone’s situation and position is unique. Going into your tax planning sessions well-prepared, and with the mindset that nothing is irrelevant, will help position you well for tax time. Reach out to your local GreenStone tax and accounting professional if you need assistance with your bookkeeping or to set up a tax planning meeting. Our team is always available to help you with your financial planning needs!

To view the article in the online 2019 Fall Partners Magazine, click here.