Syndicated Finance

Within GreenStone, the Capital Markets team is uniquely qualified to structure and facilitate the execution of syndicated loans. By utilizing the syndicated loan market, borrowers are provided with access to capital beyond what GreenStone might be able to provide based on a borrower’s individual needs. GreenStone works closely with both commercial banks and Farm Credit associations to ensure loans are syndicated to industry experts with vast experience in agricultural lending.

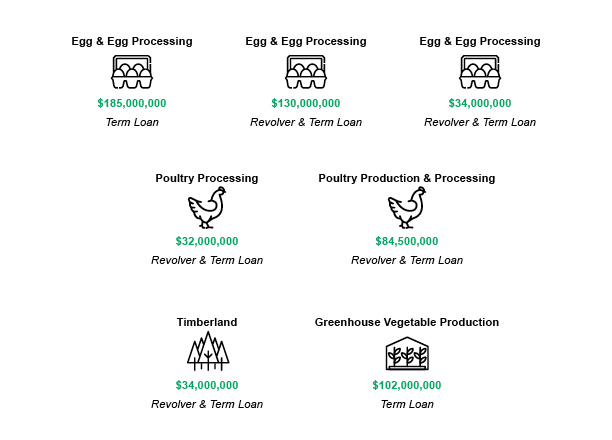

Representative Food & Agricultural Financings:

GreenStone as Lead Agent or Syndication Agent

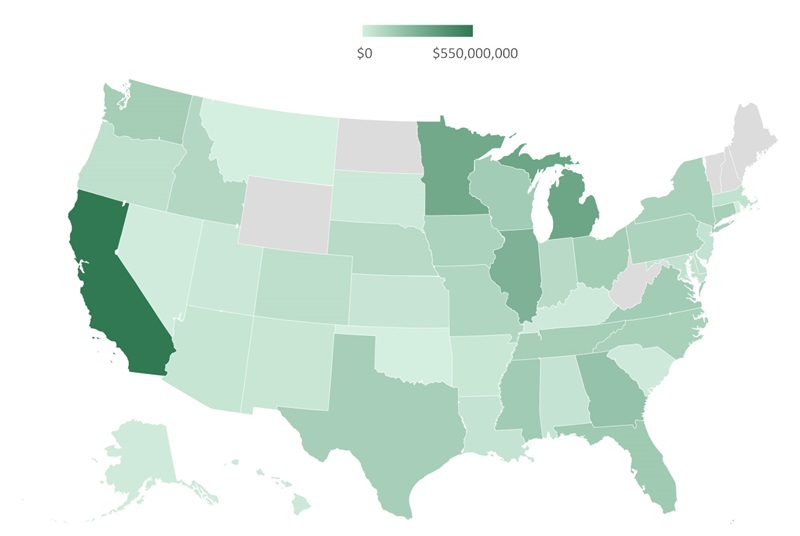

Syndicated Loan Concentration by State

In addition to originating agribusiness loans, GreenStone Capital Markets participates in the broader syndicated loan market to diversify its portfolio, both geographically and by industry. Large scale syndicated loan structures allow lenders to spread risk and take part in financial opportunities that may be too large for their individual capital base or considered too risky to hold outright. In the syndicated loan market, GreenStone Capital Markets works primarily with large commercial banks as well as Farm Credit System banks and associations. By balancing its originated loans with syndicated loans, GreenStone Capital Markets provides shareholders immense diversification spanning the country.