Published 10/29/2020; Updated 11/23/2020

2020 has been an extremely challenging year for farming operations! If you’ve received a PPP loan as a lifeline to help cashflow for payroll, rent and utilities – congratulations! That money is likely already spent, so now we need to focus on tax implications of your PPP loan and its forgiveness (hopefully). It’s also important to know of other uncertainties and open questions in the process.

The PPP loans were extremely enticing because farmers knew going in that they’d be able to apply for forgiveness, as long as the PPP loan proceeds were spent on eligible payroll, interest, utilities and rent expenses. But the program has come with a significant question: Will the IRS tax farmers on the loan received?

The CARES Act detailed that the forgiven loan amount would not be included in taxable income. This meant that farmers would not pay taxes on the monies received. The intention of the CARES Act and the PPP loans was to provide farmers with the money necessary to keep running operations and continue paying employees, not to create a tax burden for those receiving the funds.

There’s a catch, though! IRS Notice 2020-32 clarified how the forgiven loan amount would be treated when it comes to your taxes:

“This notice clarifies that no deduction is allowed under the Internal Revenue Code (Code) for an expense that is otherwise deductible if the payment of the expense results in forgiveness of a covered loan pursuant to section 1106(b) of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), Public Law 116-136, 134 Stat. 281, 286-93 (March 27, 2020) and the income associated with the forgiveness is excluded from gross income for purposes of the Code pursuant to section 1106(i) of the CARES Act.”

11/23/2020 Update: The IRS doubled down on this position in late November with Rev Rul 2020-27. The ruling denies taxpayers the ability to deduct expenses “forgiven” under the PPP loan program incurred in 2020, even if you wait until 2021 to ask for forgiveness. The IRS’s logic is that if the taxpayer reasonably expects to receive loan forgiveness, the expenses are non-deductible since the loan forgiveness is tax-free. The expenses will have been incurred and/or paid by all taxpayers as of the end of 2020, therefore taxpayers should know at year end if their PPP loan will be forgiven or not.

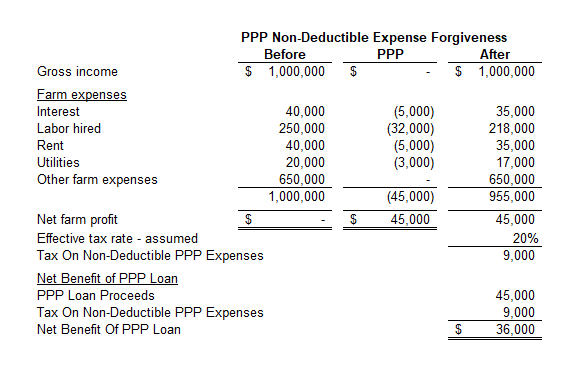

What do IRS Notice 2020-32 and Rev Rul 2020-27 mean? Since the forgiven loan isn’t included in a farming operation’s taxable income, the expenses paid for with the forgiven loan are also not able to be included as a tax deduction. This can potentially have an impact on your tax liability at the end of the year. Below is an example of how the tax interpretation could impact a farming operation in 2020 that received a $45,000 PPP loan:

The farming operation in this scenario has a tax liability as a result of receiving their PPP loan and obtaining full forgiveness. It’s important to note that the farming operation still received a net benefit, essentially free money, of $36,000 on its $45,000 PPP loan, but there may be a tax liability to consider.

These are the rules in place as of the date of this article (updated 11/23/2020). There are many questions with the current rules in place:

- Do I really have to report my expense line items “net” of the forgiven amounts? Does it make sense to report different payroll amounts on my tax return than what I show on my year end payroll forms? Same question for 1099’d eligible expenses?

- Will my loan be auto-forgiven?

- Will Congress and the IRS align, and could the expenses be deductible and forgiveness non-taxable?

It’s clear that the PPP loan forgiveness and its tax impacts are steeped in uncertainty. It is a real possibility that Congress and the IRS align to make PPP expenses deductible – members of Congress are advocating for it along with countless other organizations. However, there is no guarantee and it could be well into 2021 until a farmer has these answers! Taxpayers may consider, in consultation with their CPA, filing extensions for their 2020 tax returns to hold off on filing until there is further clarity on the tax implications of the PPP forgiveness process.

Taxpayers may need to make estimated tax payments this year if you do choose to extend – something that farmers are not accustomed to doing.

So, what should you do?

With all of the uncertainty, you need to control what you can control.

Make sure that you utilized the PPP loan proceeds for eligible expenses during your elected covered period based on the current rules in place. Keep good records of your loan and eligible expenses as the SBA has a 5-year statute of limitations to audit your loan.

Given the current commodity pressures and political uncertainties, be prudent with working capital if at all possible and be mindful of your operating expenses and large capital expenditures. Tax planning through prepaying expenses may not be the best course of action in 2020. It may make sense to pay additional tax and maintain working capital funds heading in to 2021.

Year end is always a very important time for farmers to complete tax planning, and with all of the changes this year, government aid provided to farmers through the form of PPP, CFAP, CFAP2, EIDL, etc., tax planning is more important than ever. It seems like I say this every year, but it’s true! Some of you may have taxable income due to the government aid and not feel it. You’ll want to make sure that you know where you stand from a tax perspective, and go into your tax planning sessions well-prepared with the mindset that nothing is irrelevant. That will help position you well for tax time.

The content of this article, first published in Michigan Farm News, is accurate as of the update on November 23, 2020. Please continue to check with GreenStone for updates on this fast-moving topic.