On July 4, 2025, The One Big Beautiful Bill (OBBB) was signed into law to extend, enhance and, in some cases, make permanent some of the Tax Cut Job Act’s tax law changes from 2018. It will bring back additional options for you come tax season filing time – and it may add difficulty in filing your return by March 1 this year as tax accountants and their software providers work through all of the OBBB changes.

Many farmers operate under the common misconception that all farm income tax returns are due by March 1 each year. While that is one of the deadlines, it does not have to be the case for all farmers. The IRS allows farmers and fisherman to avoid paying income tax estimates during the year if the following criteria are met:

- 66.67% of your gross income for the current tax year or the prior tax year is from farming

- You file your tax return and pay all the tax due by March 1

In addition, if no income tax is due, the farm return is not due until the normal April 15 individual filing deadline.

Due to the nuances and rules involved, many times farmers simply say they want to file by the March 1 farm deadline, but there are reasons to consider other options.

Why not March 1?

Meeting a March 1 due date is becoming harder and harder from a compliance standpoint. Many farmers receive 1099s from their cooperatives and other business activities such as rent, custom hire work, and other miscellaneous income, and are not receiving those until late in February.

Farmers who have outside pass-through entities with ownership for which they receive K-1s or have personal brokerage investments for which they receive a 1099 have the same challenges with not receiving the necessary documents until late February. The timing of receipt of this information creates a struggle to properly prepare farmers’ tax returns by March 1.

What other options do farmers have?

Rather than being forced into the March 1 time crunch, farmers can make an estimated tax payment on January 15 and then have until April 15 to complete the return and make a payment due for any remaining tax.

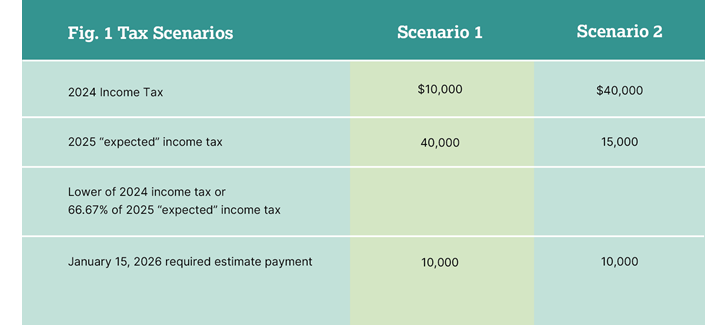

The January 15 payment plan comes with two options for the farmer. The IRS did farmers a favor by allowing them to pay by January 15 the lower of 100% of the prior year’s tax or 66.67% of the current year’s expected tax.

The options help accommodate the income volatility often experienced as a result of crop yields, commodity prices, and/or in recent years government aid. Paying at the lower of the prior or current year allows the farmer to hold onto more of their cash for as long as possible.

Below is an example of how this would work in two different scenarios:

Balances due at the completion of the tax return would be offset by these January estimated payments made. For example, in scenario 2, if the tax return were finalized and the farmer had income tax of $15,000 per the tax return, the $5,000 balance would be owed as of the filing date — typically April 15.

Making the January 15 estimated income tax payment can be extremely useful for a farmer especially in years where your taxable income will be higher than the previous year. It provides more time, until April 15, to file a correct individual income tax return that maximizes tax deductions. You receive 45 more days to see how the current year is going as well – which can help with decisions on how aggressive you are in utilizing Section 179 and bonus depreciation methods.

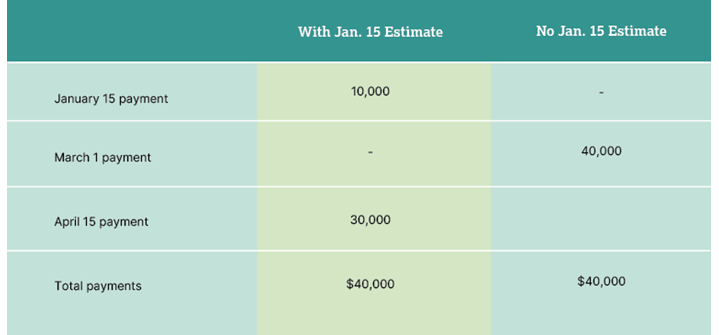

Additionally, considering the cost of funds and timing of the payments made, it could result in a net benefit from an interest standpoint. Using scenario 1 from above, consider the following payment dates for a farmer that did or did not make an estimated income tax payment by January 15:

The same amount of tax was due regardless of whether an estimated payment was made — it simply moved the timing of the required payments. In this scenario, a $10,000 payment was made 45 days ahead of the March 1 date, but the remaining $30,000 was not due until April 15. At the current prime interest rates, this would save the farmer approximately $200 in interest costs when paying the income tax from an operating loan.

Whether for interest savings or documentation receipt timing and filing accuracy, adjusting your farm tax filing process may be a solution worth considering. Should you have any questions how this would work for your specific situation, consult with your CPA or your GreenStone income tax professional.