Future Tax Considerations

Before I get into the meat of this article, I first must pause to note that I am down my #1 reader of the articles I write. My wife’s grandmother passed away in mid-March at the age of 98 – she was around farming her entire life in Six Lakes, Michigan and was a devote follower of the industry. I’ll keep sharing important information and writing these articles not only because of the value they give our members, but because I know she would have enjoyed them!

There are a number of observations and items for you to be aware of and to monitor going forward that may impact you come tax filing time in the future!

Avoid March 1 Stress! March 1 is known as the farmer tax filing deadline for individual income tax returns. Farmers are exempt from a penalty for failing to file estimated taxes if they:

- File their return and pay all tax due by March 1. OR

- Their income tax withholding will be at least 66.67% of the total tax shown on their current year tax return or 100% of the total tax shown on their prior year return.

Alternatively, farmers may choose to make only one estimated tax payment by January 15 each year. Those who choose this option may file their return and pay the remainder of the tax due on the standard tax April 15 filing deadline. Qualifying farmers making one estimated tax payment by January 15 must pay the smaller of:

- 66.67% of their current year tax. OR

- 100% of the tax shown on the prior year return.

For joint returns, the spouse’s income must be considered in determining if the taxpayer meets the two-thirds of gross income from farming requirement.

Why is this significant? Meeting a March 1 due date is becoming increasingly difficult from a compliance standpoint. Many farmers receive 1099s from their cooperatives and other business activities such as rent, custom hire work, and other miscellaneous income, and are not receiving those until late in February. This year the USDA issued corrected 1099s for farmers whose premiums for dairy margin coverage was paid by their proceeds, which caused stress in filing by March 1 for some dairy farmers. Additionally, farmers who have outside pass-through entities with ownership for which they receive K-1s or have personal brokerage investments for which they receive a 1099 have the same challenges with not receiving the necessary documents until late February. The timing of receipt of this information creates a struggle to properly prepare farmers’ tax returns by March 1.

This year, farmers that paid an estimate by January 15, have the advantage of waiting to see if the government passes the Tax Relief for American Families and Workers Act of 2024 that would reinstate bonus depreciation amongst other retroactive tax law changes that they could take advantage of for their 2023 tax filing. Consider making quarterly estimates in 2024 or a single estimate in January 2025 to extend your filing deadline next year!

Tax Law Changes Coming? Many tax breaks established by the Tax Cuts and Jobs Act (TCJA) of 2017 are set to expire at the end of 2025. The USDA’s Economic Research Service estimates that farmers taxes will increase more than $9 billion between higher income and estate tax liabilities if the TCJA is not extended.

As we consider this, let’s look at which ones will impact farmers the most:

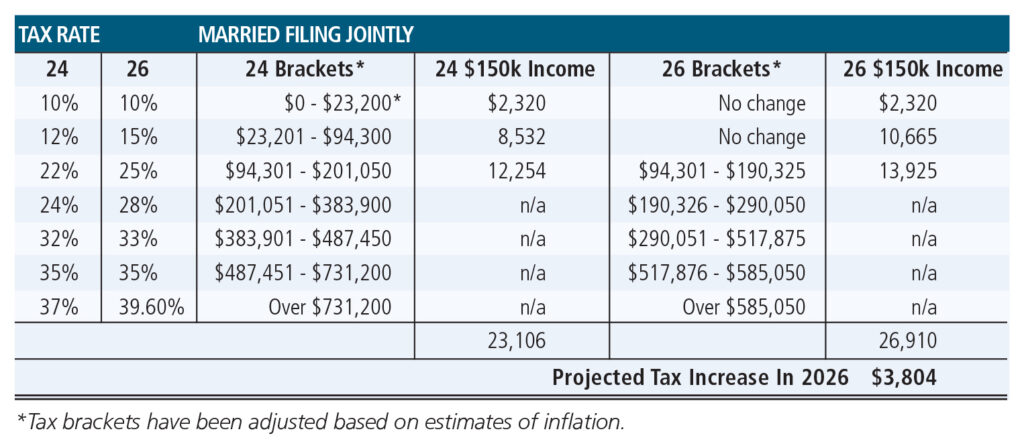

- Increased tax rates: The tax brackets will be lowered and rates in most brackets will increase. The below table presents the change in tax for a married filing jointly taxpayer with $150,000 in taxable income:

In this scenario, a taxpayer making $150,000 in both 2024 and 2026 will be paying in almost $4,000 more in tax in 2026.

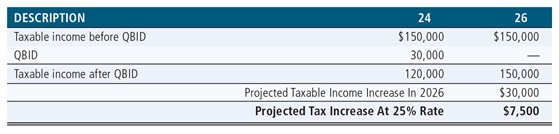

- Expiration of Section 199A: Section 199A, also known as the qualified business income deduction (QBID), is a 20% deduction for income that individuals receive from business activities. Unless later extended or made permanent, this 20% deduction will no longer be available after 2025. A taxpayer with $150,000 in business activity income will have their taxable income and tax due increase approximately as shown below starting in 2026:

- Estate Tax Exemptions Decreasing: American taxpayers with considerable estates benefit from larger exemptions under the TCJA. The TCJA doubled the estate and gift tax exemption for individuals, from $5.49 million in 2017 to $11.18 million in 2018. Adjusted for inflation, the exemption was $12.92 million in 2023 and it increased to $13.61 million in 2024. This means an individual can now pass on up to $13.61 million in assets without being subject to Federal estate or gift taxes. For married couples, this effectively allows a combined exemption of $27.22 million. In 2026, the exemption amounts are set to decrease back to pre-TCJA inflation adjusted amounts.

Estate lawyers are busy assisting farmers that will be impacted by this change in establishing plans to utilize the higher exemption amounts yet in 2024 and 2025 before the sunset occurs. It is best to plan ahead if you think your estate may trigger estate tax at the lowered exemption amounts.

Other items with less consequence, but still impactful are that the standard deduction is set to decrease, the child tax credit could be reduced and phased out based on taxable income levels, and the alternative minimum tax exemption amounts will be reduced.

So what should you do? Understand how the above items impact your income tax position. Discuss these changes with your tax accountant. Consider pushing more income into 2024 and 2025 if possible at lower rates. If you believe you will have a taxable estate after 2025, act now; do not wait until closer to the deadline.

Reach out to your local GreenStone tax and accounting professional if you need assistance with any financial related services. Our team of experts is ready to help!

To view the spring 2024 issue of Partners magazine in its entirety, click here.

We’re here to help.

With locations across Michigan and northeast Wisconsin, we’re here when you’re ready to talk.