In April, President Biden announced the American Families Plan. The administration has referred to it as an investment in our kids, our families and our economic future.

Significant benefits in the plan include universal pre-school for all 3- and 4-year-olds, free community college to all Americans, direct support to children and families in regards to childcare, a national comprehensive paid family and medical leave program, extensions of the ACA premium tax credits, an extension and increase of the child tax credits, and an expansion of the earned income tax credit.

These benefits need to be paid for somehow, and the American Families Plan included details of proposed tax law changes as well. Those include, but are not limited to, higher individual income tax rates for income in excess of $400,000, expansion of the net investment income tax to all income in excess of $400,000, and elimination of tax-free like-kind exchanges when gains exceed $500,000.

The proposed tax law changes have, at many times, been presented as only impacting the wealthy. That said, they may have positive or negative impact on agricultural producers; it’s definitely complicated!

There are also significant proposals being floated to change estate tax laws — including Sen. Bernie Sanders’ 99.5 Percent Act and a Democratic Coalition proposal called the Sensible Taxation and Equity Promotion (STEP) Act.

First let’s summarize current estate law: When the owner of a farm or ranch dies, the estate is subjected to federal estate taxes.

Currently, $11.7 million per individual and $23.4 million per couple in assets are exempted from the estate tax, effectively protecting most farms from the estate tax. When a decedent passes farm assets to an heir, the heir can take fair market values as their basis in the property (i.e., stepped-up basis), effectively avoiding capital gains taxes.

Given that cropland values have roughly tripled over the past 25 years, most producers are extremely sensitive to any changes to the estate tax exemptions or stepped-up basis.

Sanders’ 99.5 Percent Act would decrease the estate tax exemption to $3.5 million ($7 million per couple), among other things. The STEP Act proposes to eliminate stepped-up basis upon death of the owner.

What percent of agricultural producers would be impacted by one or both proposals? Well, the Agricultural and Food Policy Center (AFPC) at Texas A&M University released a report of their findings on June 15, 2021. Let’s just say it’s alarming. The AFPC report can be found here: https://republicans-agriculture.house.gov/uploadedfiles/rr-21-01-afpc-tax7.pdf

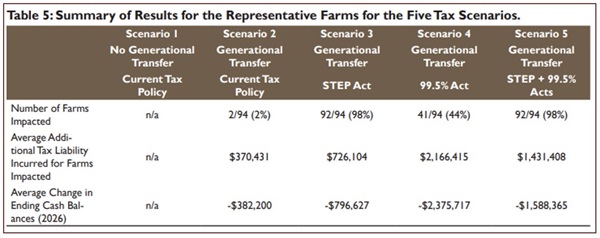

AFPC maintains a database of 94 farms located in 30 different states. Below is a table from page 16 of their report to show findings and the impact of these proposals individually and in conjunction on these 94 farms:

As you can see, 92 of 94 farms would be impacted by the STEP Act, and 41 of 94 would be impacted by a generational transfer tax! These proposals create significant income tax liabilities for almost all these 94 farms, as evidenced by the average change in ending cash balances.

There’s an old saying that farmers are cash poor, dirt rich. This is due to the asset-intensive and low-margin nature of the agriculture sector.

The USDA Economic Research Service’s February 2021 Farm Income Forecast showed that the projected five-year average rate of return on farm assets is 2.8% — significantly lower than the median five-year average return on assets for the S&P 500 of nearly 8%.

At this rate, $1 million in farm assets only generates an annual income of $27,800. Farmers’ strongest asset historically is their land, which is illiquid — land values have always risen, and farmers use it as the primary collateral to fund their business operations.

The 99.5 Percent Act and STEP Act, in many instances, will create significant tax liabilities upon transfer for many capital asset-intensive businesses like farms.

Farming is a family business — in excess of 95% of our nation’s 2 million farms are owned by families individually, through partnerships and corporations. The goal multi-generational farmers strive for is to hand the farm off to the next generation in a better operating and financial position than when they received it.

These proposed tax law changes could be a huge blow to that goal. It straps generational transfers with debt loads that may or may not be supportable by business operations. It will cause farming families to consider their options. Do they:

- Take on the debt load resulting from a generational transfer

- Sell a portion of their land to cover the tax

- Get out of farming altogether because it doesn’t make sense to keep farming

The Biden administration has proposed creating tax carve outs that it says will protect farmers and ranchers — not all the details are available at this time. One proposal noted that, as the farm stays in the family, no tax is due. But the tax will eventually still be due — and the decisions farmers would have to make to pay the tax are all still there.

U.S. Sen. John Boozman (Republican), ranking member of the Senate Committee on Agriculture, Nutrition, and Forestry stated, “The data speaks for itself and should give pause to anyone considering this approach as an option to pay for new additional federal spending. If changes of these magnitude are pursued, as some have discussed, the economic harm it will cause will have a lasting impact on rural America.”

It isn’t just Republicans voicing concerns with these proposals. House Agriculture Committee Chairman David Scott (Democrat) wrote Biden earlier this month that while he supports the American Jobs Plan and the American Families Plan, he is worried the proposals to increase taxes to pay for these programs could hurt farmers.

"I am very concerned that proposals to pay for these investments could partially come on the backs of our food, fiber, and fuel producers," Scott wrote.

Agricultural producers should pay close attention to these proposals soon to understand how their farming operations may be impacted.

Texas A&M Study: rr-21-01-afpc-tax7.pdf (house.gov)

Farm News Media: Texas A&M study confirms devastating impact of Inheritance Tax Code changes on family farms - Michigan Farm News

*Written for the Michigan Farm News Dollars and Sense Column

Tags

Request for Information | Apply Now | Tax and Accounting Services